I'm not a tax professional, but I do know that when it comes to employee benefits, surprises are rarely good. So let's dig in.

By Michelle J. Smith | February 14, 2020 at 10:11 AM

Few want to talk about taxes, but when it comes to disability coverage, a bit of tax understanding puts us in place to make sound decisions. I'm not a tax professional, but I do know that when it comes to employee benefits, surprises are rarely good. So let's dig in. Disability coverage is categorized as income and, as such, is subject to taxation. It's important to understand how taxation will impact a benefit in the event of a disability so that employees can be prepared. Savvy employers will have a 'sick pay' plan in place in case an employee or owner experiences a disability which results in time off work. This benefit/income will then be taxed according to the plan put in place. Paycheck insurance or disability insurance is any amount paid to an employee because of an employee's absence from work due to an injury, sickness or a disability. Disability pay can come from the employer or a third-party, such as an insurance plan. Sick pay benefits paid by an employer or third party are considered the gross income of an employee if the employer pays part or all the premium for coverage. As such, it is subject to taxation.

What is taxed?

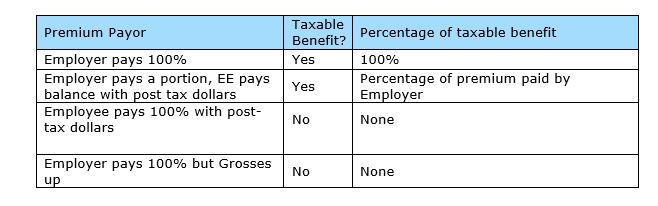

Either the premium or the benefit is taxed. If the employer pays the entire premium, then the employee pays all taxes on the benefit. If the employer pays any part of the premium and the employee pays the remaining balance with post-tax dollars, then the benefit received is taxed in the same proportion. If the employee pays the whole premium with post tax dollars, then the benefit received is not taxed.